Prosperity 3a

Targeted investment.

Plan effective

pension provision.

With Prosperity 3a

Save tax.

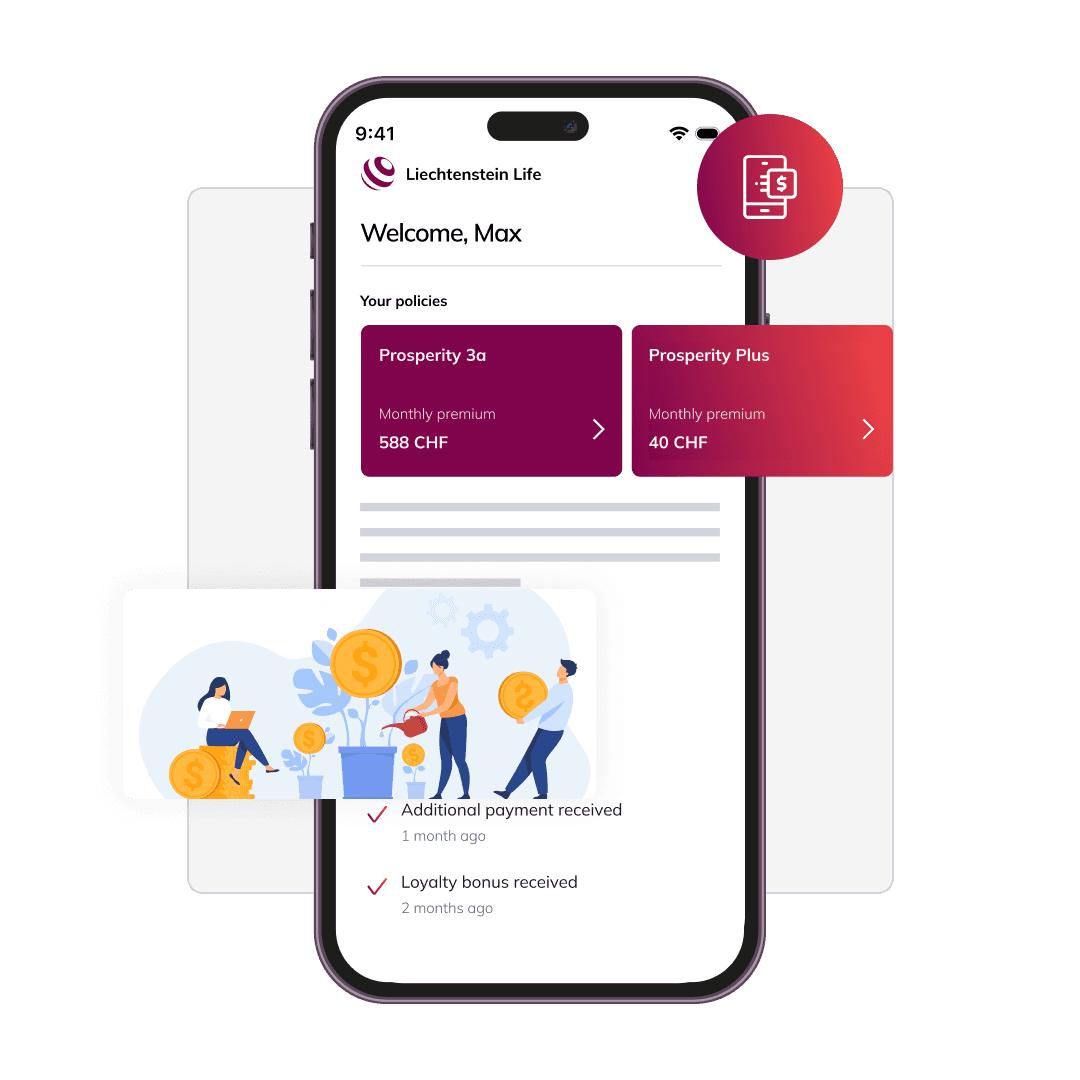

Unit-linked pension solutions combine your pension plan with asset growth. So your money isn’t just spent – it’s working for you. Government-sponsored! Benefit from tax advantages and minimise progressive taxation on your income. A smart move for financial independence.

Act today and enjoy peace of mind tomorrow. The state and your occupational pension only cover around 60 % of your final income. If you take care of your private pension provision early, you can close this gap. For your standard of living. Your dreams. And your loved ones.

Pillar 3a – the central pillar for individual pensions in all situations. It complements old-age and survivors’ insurance for employees and self-employed persons. Early pension schemes offer interest benefits and allow tax savings – a double benefit! The third pillar helps you to maintain your standard of living in retirement while also saving tax.

The tax benefits of pillar 3a

- Tied pension provision (completion via insurance companies and/or banks)

- In the deposit phase, contributions paid in reduce taxable income

- No withholding tax: Interest payments on pension accounts are tax-free during the term

- Tax deductions remain possible until the age at expiry (maximum of five years after reaching the AHV age)

CHF 7,258

CHF 36,288

Your benefits:

- Make full use of intelligent tax benefits

Significant tax benefits from a tied Pillar 3a pension plan

- Create a home

Advanced withdrawal for financing an owner-occupied home

- Flexibility when it really matters

Premium exemption in the event of incapacity to work due to illness or accident (6, 12 or 24 month-long waiting times)

- Pension payments in case of emergency

In the event of incapacity to work min. CHF 6,000, max. CHF 38,000 per year (12 or 24 month-long waiting times)

- Can be adapted to suit life’s circumstances

Premium increases, premium reduction and interruption of premium payments are possible

- Risk protection in the event of an emergency

Individually selectable death benefit insurance up to 500 % of the total amount

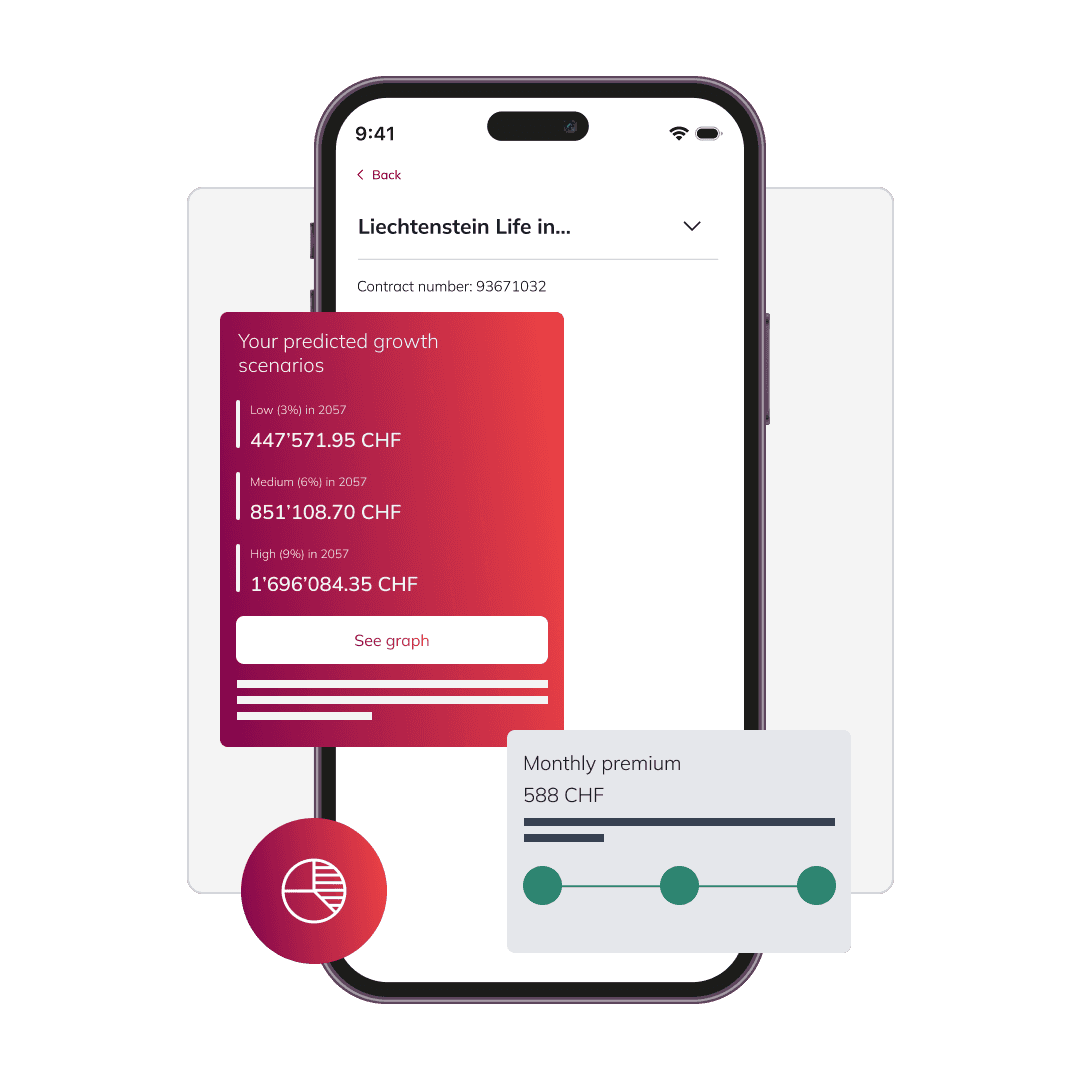

New goals? Change your investment strategy! Shift investments from one fund to another in order to react intelligently to market change. Switch by changing the distribution of your future deposits to keep the portfolio up-to-date and tailored to you.

The parachute for your pension plan! If retirement is approaching, end-of-contract management ensures that your investments are transferred to low-risk investments. This protects your saved capital – ensuring you can glide into retirement with ease!

Make sure you have a robust portfolio! If the value your investments changes, it can affect your strategy. By rebalancing, you sell or buy investments to restore the desired split and manage the risk. An important process to achieve your financial goals.

Still have questions?

We can answer them! There are different ways to contact us. We will be happy to help you.